Why Bookkeeping Gets Delayed (And Why It’s Often Not the Bookkeeper’s Fault)

One of the most common frustrations in bookkeeping isn’t complicated transactions or tricky reconciliations—it’s missing or delayed information from clients.

Even the most skilled bookkeeper can only work with what’s provided. To keep books accurate and up to date, a few essentials are required:

Invoices and receipts

Bank and credit card statements or active bank feeds

Explanations for transfers, owner draws, or unusual transactions

Payroll records and employee expense reports

Timely responses to questions and requests

When any of these pieces are missing, the entire bookkeeping process slows down. Reconciliations stall, reports are delayed, tax preparation becomes more difficult, and cash flow visibility suffers

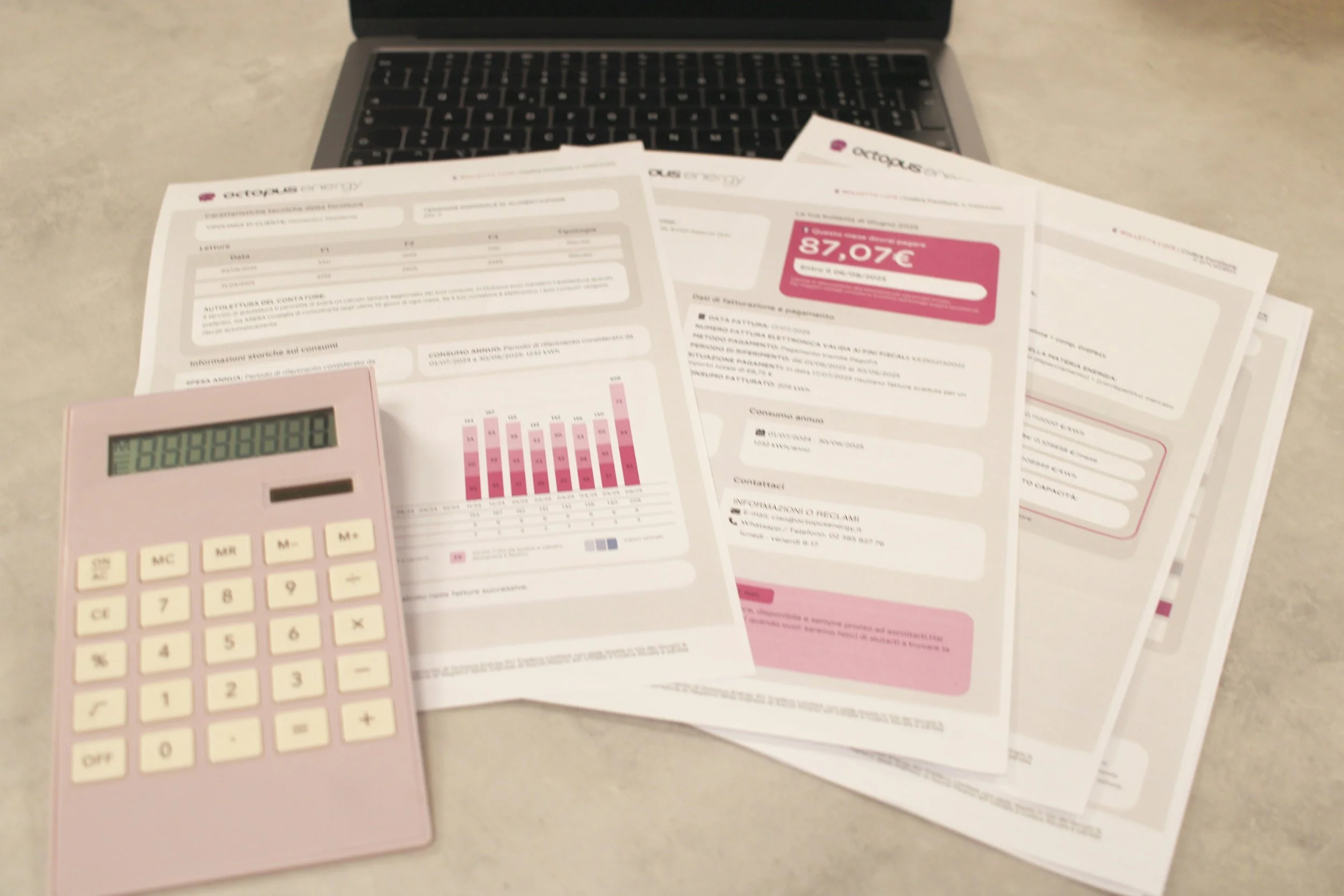

Why completing your Self-Assessment before Christmas is a priority

Every year, over a quarter of people due to file a Self-Assessment tax return complete it in the final 4 days before the 31st January deadline

And 5% of returns are filed in the final 24 hours.

However, leaving it to the last minute isn’t really wise as you never know what may come up to prevent you from completing it in time.

With an instant fine of £100 if you miss the deadline, and daily fines of £10 (for up to 90 days) if you haven’t filed by 30th April – there are plenty of financial incentives not to be late.

Besides the obvious problems shown above, here at The Hollies Bookkeeping Services in Shropshire know there are a few more very persuasive reasons why you should complete your Self-Assessment before the Christmas holidays.

Companies House Fees Are Changing From 1 February 2026 – What This Means for Your Bookkeeping

Companies House carries out an annual review of its fees to ensure they accurately reflect the cost of delivering its services. As a result of the latest review, several key fees will change from 1 February 2026.

Here’s what you need to know:

The incorporation digital filing fee will change to £100

The confirmation statement digital filing fee will change to £50

The voluntary strike-off digital filing fee will change to £13

A full list of all fee changes has been published for businesses to review.

Companies House says these fees remain low when compared internationally, and they support essential services that benefit every business registered with Companies House—such as limited liability protection, improved access to finance, and greater credibility in the marketplace.

The Hollies Bookkeeping are finalists in the LUCA Bookkeeper’s awards!

The Hollies Bookkeeping Services in Shropshire is delighted to announce we are finalists in the LUCA awards, better known as the Oscars of the Bookkeeping Awards!

We entered the awards earlier this year and were recently revealed as one of six finalists in the Large Practice of the Year category.

After much discussion and deliberation from our judges we are pleased to announce the finalists for the LUCA Bookkeepers Awards 2025. The finalists have been chosen by a panel of independent judges as the very best from this year’s impressive selection of entries.”

The team will find out if they are winners at the awards dinner on 17 November at the QEII Centre, London.

Identity verification launches November 2025 — make sure you’re ready!

From 18 November 2025, new legal requirements under the Economic Crime and Corporate Transparency (ECCT) Act 2023 mean all company directors and people with significant control (PSCs) must verify their identity with Companies House.

This change is designed to reduce fraud and improve corporate transparency.

Please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk

Taxpayers encouraged to ensure returns are correct and complete

HMRC has released updated Guidelines for Compliance (GfC13), outlining its expectations of taxpayers who may be considering applying novel or unlikely interpretations of tax law, or who are uncertain about how the law applies when preparing tax returns or related documents.

Please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk

Mistakes small businesses and the self-employed should avoid

Even though it’s important to make sure your financial records are accurate, it’s not often the most exciting part of working for yourself, so here are some mistakes small businesses and the self-employed should avoid.

It’s easy to focus on the more enjoyable aspects of running your business, but pushing bookkeeping to the back of your mind – and letting the documents pile up – really can cause you issues down the line.

Please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk

Making Tax Digital for income tax is a key part of the Government strategy.

This month here at The Hollies Bookkeeping in Shropshire we want to provide you with a summary of the key measures announced by the government as part of a tax administration and simplification update,

These measures announced at the end of April, include a welcome delay to plans for mandatory payrolling of benefits in kind (BIK).returns digitally. They’ll also move from an annual return to quarterly returns.

If you are concerned about how any of the changes could affect your business, please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk

Government announces raft of tax simplification measures

This month here at The Hollies Bookkeeping in Shropshire we want to provide you with a summary of the key measures announced by the government as part of a tax administration and simplification update,

These measures announced at the end of April, include a welcome delay to plans for mandatory payrolling of benefits in kind (BIK).returns digitally. They’ll also move from an annual return to quarterly returns.

If you are concerned about how any of the changes could affect your business, please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk

Making Tax Digital for income tax – a guide for landlords

MTD for VAT-registered businesses was rolled out for those with turnover above the VAT threshold in 2019 and extended to all VAT-registered businesses in 2022.

What is MTD for ITSA?

The next stage of the initiative is Making Tax Digital for income tax and Self Assessment (MTD ITSA). This will require Self Assessment taxpayers to use government-approved software to file their tax returns digitally. They’ll also move from an annual return to quarterly returns.

If you are concerned about how any of the changes could affect your business, please contact The Hollies Bookkeeping Services on 01743 790086, email info@holliesbookkeeping.co.uk or visit www.holliesbookkeeping.co.uk